Chase Freedom Flex Categories: 5% Cash Back Calendar

The Chase Freedom Flex® card has become a go-to option for smart spenders looking to maximize their cash back or Ultimate Rewards®. With its rotating bonus categories and the ability to earn 5% back on select purchases, the calendar is packed with opportunities for cardholders to earn and save. We’ve gathered the Chase Freedom Flex bonus categories for , how they work, and the best practices for maximizing your rewards.

Overview of Chase Freedom 5% Cashback

How the Chase Freedom Flex Card Works

✦ 5% Rotating Categories ✦

Get $200 cash back after spending $500 on purchases in the first 3 months from account opening (statement credit), plus 0% intro APR on purchases and balance transfers for the first 15 months.

Annual Fee: $0

Apply now

Terms apply. Offers subject to change. Refer to card issuer for full details.

About 5% Cash Back Rotating Categories

Rotating categories are the key feature of the Chase Freedom® (legacy) and Chase Freedom Flex cards, allowing cardholders to earn elevated cash back rates on specific types of purchases during designated periods.

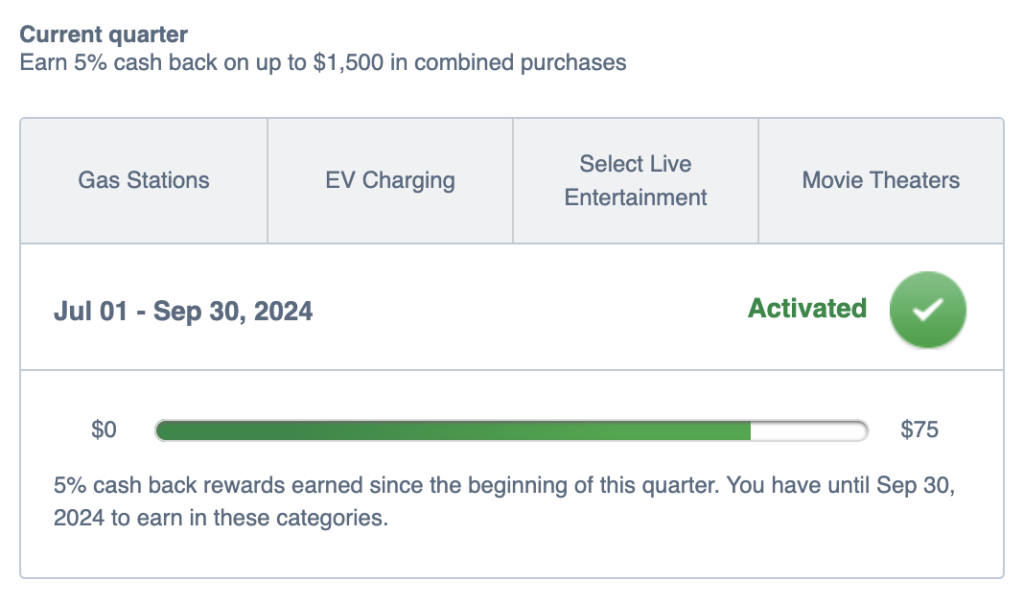

Each quarter, you can earn 5% back (5 Ultimate Rewards) per dollar on up to $1500 combined spending within active bonus categories—such as Groceries, Gas, and Restaurants, and merchants like Amazon, Lowe’s, and Walmart. That’s up to $75 back each quarter on bonus categories. This system rewards cardholders who plan their purchases based on the current cash back opportunities, creating a dynamic way to earn a stellar multiple from your everyday spending.

How to Activate 5% Cash Back Bonus Categories Each Quarter

To take advantage of the bonus categories, you’ll need to activate them each quarter. This is a straightforward process that can be done directly online, through your Chase account, or via the Chase mobile app. Simply log in, navigate to the Freedom Flex card section, and you’ll find an option to activate the current quarter’s categories.

Make sure to do this within the activation period, which is usually 15 days before the quarter begins and 15 days before it ends. If you activate after the quarter has started, rewards will be applied to any purchases will be retroactively, but missing activation altogether means you’ll miss out on earning that valuable 5% back.

Additional Ways to Earn Cash Back

In addition to the quarterly rotating 5% categories, the Chase Freedom Flex card also comes with standard elevated cash back in the following categories:

- 5% back on Travel purchased through Chase Travel

- 3% back on Restaurants (including Takeout and Delivery)

- 3% back on Drugstores

- 1% back on Other purchases

Tip: Rotating categories can stack with a standard category bonus. For instance, if Restaurants or Drugstores are a quarterly category, you would earn 7% back on those purchases (5% for the quarterly category and the +2% standard category bonus).

What are the Current 5% Chase Freedom Flex Categories?

Q1 2026 (Jan-Mar)

✦ Restaurants – Norwegian Cruise Line – American Heart Association ✦

These are the Chase Freedom and Chase Freedom Flex 5% bonus categories for Q1 2026, for eligible purchases made between January 1 and March 30, 2026, along with any fine print specifics:

🍝 What counts as Restaurants?

Eligible for sit-down or eat-in dining, including fast-food restaurants and fine-dining establishments. Merchants that sell food and drinks located within facilities such as sports stadiums, hotels and casinos, theme parks, grocery and department stores will not be included in this category unless the merchant has set up such purchases to be classified in a restaurant category. Delivery and takeout services will be included if they are classified as a restaurant merchant. Purchases at bakeries, caterers, meal kit delivery services, and gift card merchants are not eligible.

Tip: Freedom Flex earns a standard 3% on Restaurants. When its a quarterly category, it earns 7% on Restaurants (1% base + 2% restaurant bonus + 4% quarterly bonus)

🛳️ What counts as Norwegian Cruise Line®?

Eligible for cruise fare purchased directly with Norwegian Cruise Lines. However, purchases made with 3rd party vendors or travel agencies are not eligible.

🏥 What counts as American Heart Association?

Eligible donations submitted directly through the American Heart Association’s official channels. Local chapters may not be eligible due to transaction processing procedures.

See the full terms from Chase

Q4 2025 (OCT-DEC)

✦ Department Stores – Chase Travel – Old Navy – PayPal ✦

These are the Chase Freedom and Chase Freedom Flex 5% bonus categories for Q4 2025, for eligible purchases made between October 1 and December 31, 2025, along with any fine print specifics:

Tip: If you’ve got a Chase Freedom Flex® or Chase Freedom® card, you can sign up for the Q4 bonus categories online or in your Chase account starting September 15 until December 14, 2025.

🛍️ What counts as Department Stores?

Eligible Department Stores include merchants with multiple departments such as apparel, home furnishings, furniture, electronics, cosmetics, housewares, and major household appliances. Purchases made on a department store merchant’s website are included. Purchases at Supercenters, discount stores, or specialty stores (e.g., stores that sell primarily one line of products, such as shoe stores, pet stores, electronics stores, clothing stores), and online marketplace websites (online stores that do not have physical locations and sell a variety of products) are not eligible.

✈️ What counts as Chase Travel℠?

Eligible Chase Travel purchases include prepaid travel purchases (including airline tickets, hotels, car rentals, cruises, activities, and tours) made on chasetravel.com or by calling the number on the back of your card to book. Any items or charges not paid for on chasetravel.com or by calling the number on the back of your card will not qualify. Any portion of your purchase paid for using points will not qualify.

🧣 What counts as Old Navy®?

Eligible Old Navy purchases include transactions made through Old Navy stores, including physical stores and online. Purchases on other Gap, Inc. brands are not included (i.e., Gap, Banana Republic, Athleta, etc.)

💸 What counts as PayPal (December only)?

Eligible PayPal transactions include purchases made using your Chase Freedom card with PayPal. Person-to-Person (P2P) transactions made with your Chase Freedom card on PayPal may not be eligible for 5%, and purchases made using PayPal at merchants in the current 5% quarterly categories will earn a total of 5% cash back.

See the full terms from Chase

Chase Freedom Calendar: Examples of Past Card Bonus Categories

2025

- Q4: Department Stores, Chase Travel, Old Navy, PayPal (December only)

- Q3: Gas Stations & EV Charging, Select Live Entertainment, Instacart

- Q2: Amazon, Select Streaming Services. Bonus: Internet, Cable, and Phone Services (June only)

- Q1: Grocery stores, Gym/Fitness, Spa services, Norwegian Cruise Line. Bonus: Tax Prep and Insurance (March only)

2024

- Q4: PayPal, McDonald’s, Pet shops and Vet services, Select charities

- Q3: Gas & EV Charging, Movie Theatres, Live Entertainment

- Q2: Amazon.com and Whole Foods, Restaurants, Hotels

- Q1: Grocery stores, Gym/fitness, Self-care and spas

2023

- Q4: Wholesale clubs, Select charities, PayPal

- Q3: Gas stations, EV charging, Select live entertainment

- Q2: Amazon, Lowe’s

- Q1: Grocery stores, Target, Fitness clubs and gym memberships

2022

- Q4: Walmart, PayPal

- Q3: Gas stations, Rental car agencies, Movie theaters, Select live entertainment

- Q2: Amazon, Select streaming services

- Q1: Grocery stores (excluding Walmart and Target), eBay

2021

- Q4: Walmart, PayPal

- Q3: Grocery stores (excluding Walmart and Target), Select streaming services

- Q2: Gas stations, Home improvement stores

- Q1: Cable, internet, and phone services, Wholesale clubs, Select streaming services

Using the Chase Freedom Flex Card for Maximum Benefits

How to Maximize Cash Back with Rotating Categories

Start by always using your card for purchases that fall within the activated bonus categories, unless you have a card that earns a higher rate. You should always align your spending with the quarterly categories.

For example, if the category for a specific quarter includes Restaurants, consider doing your dining on the card during that period. It will actually net 7% back because of the 5% quarterly bonus that stacks with the standard +2% on restaurants.

Additionally, consider setting up alerts and emails for when new categories are announced, so you can activate them promptly and plan your spending accordingly.

Redeeming Ultimate Rewards for Cash Back

Redeeming your earnings as cash back is a simple way to cash in on your rewards if you don’t travel. You can choose to apply your cash back at 1¢ per point towards your statement balance or redeem for gift cards.

Using Chase Ultimate Rewards for Travel

One of the best strategies for maximizing your cash back is to combine your Chase Freedom Flex card with other Chase cards, such as the Chase Sapphire Reserve® or Chase Sapphire Preferred® card. When you have multiple Chase cards that earn Ultimate Rewards, you can combine those rewards.

By doing so, you can take advantage of point transfer partners available to Sapphire cardholders. This will give you potentially outsized value for your accumulated points, as we often see transferred points resulting in 2x or more value on airfare and hotels.

Chase Freedom 5% Cash Back FAQ

What is the Chase Freedom 5% Cash Back program?

The Chase Freedom 5% cash back program allows you to earn a whopping 5% cash back on purchases made in specific categories that change every quarter. It’s a fantastic way to maximize your rewards on everyday spending, as long as you activate the bonus categories each quarter. It’s as easy as that.

How do I activate the bonus categories for the Chase Freedom card?

To get your 5% cash back, you need to activate the bonus categories that are available each quarter. You can do this by logging into your Chase account online or through the mobile app. Just find the section for Freedom Flex cardholders, and follow the prompts to activate. Remember, you have to do this each quarter, or you’ll miss out on those extra rewards.

Is there a quarterly limit on the cash back that can be earned?

Yes, you can earn elevated cash back on up to $1500 of combined spending on activated categories each quarter. That’s up to $75 back each quarter. After that, any spending will earn the baseline 1% cash back.

Can I still earn cash back on other purchases?

You can still earn 1% cash back on all other purchases, and any standard elevated cash back such as 3% on Restaurants and Drugstores. So, even if you’re not shopping in the current Freedom Flex categories, your everyday purchases will still earn you rewards.

What happens if I don’t activate the bonus categories?

If you forget to activate the bonus categories, you’ll miss out on the 5% cash back for that quarter. Instead, all your purchases will only earn you the standard 1% cash back. So, it’s super important to set a reminder for yourself each quarter to activate those categories and make the most of your Chase Freedom Flex® card.

Editor’s note: Opinions shared in this article are solely the author’s and do not represent the views of any bank, credit card issuer, hotel, airline, or other organization. The content has not been evaluated, approved, or endorsed by any of the mentioned entities. These are our recommendations but it isn’t financial advice. We may receive a commission if you click through any of the links in this article.

Share this article: